After the 2008-2009 global financial crisis (GFC), emerging markets firms significantly increased their borrowing. While in 2009 aggregate corporate debt in emerging economies stood at $16 trillion U.S. dollars, by 2019 it had almost tripled, reaching $43 trillion U.S. dollars. As a share of emerging economies’ gross domestic product (GDP), corporate debt rose by 25 percentage points (p.p.) during this period, from 102% to 127% (IIF, 2020). An increase in corporate bond issuances explains most of the rise in corporate debt in emerging economies (Abraham et al., 2020). The patterns in emerging economies contrast with those in developed economies, where the ratio of corporate debt to GDP declined between 2009 and 2019.

The rise in corporate bond markets has allowed firms to obtain cheap financing, but it has also generated concerns among policymakers and academics (Powell, 2017; IMF, 2019; UN, 2019). High corporate debt can pose a significant threat to the global economy because it can become unsustainable and be associated with currency and maturity mismatches. Some analysts even predicted that the corporate debt boom could trigger a financial crisis comparable to the GFC (Bloomberg, 2019; WEF, 2019). The coronavirus (COVID-19) pandemic greatly heightened concerns, as lockdowns and border closures caused a synchronized collapse in economic activity worldwide (IMF, 2020a). As economic activity halted and firms’ revenue declined, the risk of defaults and bankruptcies among highly indebted firms substantially increased (Banerjee et al., 2020). In response, policymakers implemented swift and bold efforts to assist firms and keep them afloat (Didier et al., 2020).

In this short paper, we show stylized facts on the boom in corporate debt in East Asia and Latin America since the GFC and discuss some of the main risks associated with this development. We use transaction-level data on bond issuance activity in domestic and international markets (2000-2019), which we couple with firms’ financial statements data. We focus on these two regions because they have similar income levels and have the most developed financial markets among emerging regions (Aizenman et al., 2015). They also account for a significant fraction of corporate debt issued by firms across emerging economies. Firms from East Asia and Latin America accounted for about 90% of the total amount raised in corporate bond markets by emerging economies during 2010-2019. In fact, several studies that examine financial sector issues in emerging economies compare East Asia and Latin America (Kaminsky and Reinhart, 1998; Edwards, 2010; Aizenman et al., 2011; Jeon et al., 2011).

The main messages of the paper can be summarized as follows. Firms from East Asia and Latin America substantially increased the amount of bond financing during 2010-2019. Bond financing in East Asia was conducted through domestic markets and in domestic currency denomination. Bond financing in Latin America was conducted through international markets and foreign currency denomination. In the median East Asian economy, domestic currency bonds accounted for 72% the total raised per year during 2010-2019. This share was 33% in Latin America. A pronounced expansion in the supply of funds by domestic investors in East Asia and foreign investors in Latin America seems to have been a key driver in the increased issuance activity. As firms issued more bonds, their leverage positions rose and their financial performance worsened. The economic and financial crisis triggered by the COVID-19 pandemic heightened solvency risks in both regions. In East Asia, risks have been more related to the faster expansion in overall debt and to the fact that smaller firms, issuing bonds at shorter maturities, were behind the increase in bond issuances. In Latin America, firms have been more exposed to changes in global market conditions than East Asian firms because they have relied more on foreign debt in foreign currency. Moreover, they have experienced higher currency depreciations than East Asian firms since the pandemic started.

The rest of the paper is organized as follows. Section 2 describes the data. Section 3 presents the main stylized facts of the boom in corporate debt in East Asia and Latin America. Section 4 discusses the drivers behind the growth in corporate debt and the consequences for firms. Section 5 examines firms’ risks in the context of the COVID-19 pandemic. Section 6 concludes.

Data

The analysis in this paper focuses on the largest economies in East Asia and Latin America in terms of issuance activity in capital markets. The East Asian economies are: China, Hong Kong SAR, Indonesia, Malaysia, the Philippines, the Republic of Korea, Singapore, Taiwan, Thailand, and Vietnam. The Latin American economies are: Argentina, Brazil, Chile, Colombia, Costa Rica, Mexico, Panama, Peru, and Venezuela.

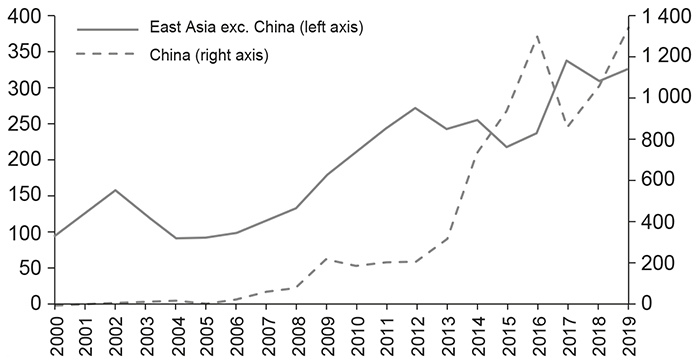

We measure bond issuance activity with transaction-level data on corporate bonds issued in domestic and international markets over 2000-19. The data come from Refinitiv’s Security Data Corporation (SDC) Platinum, which provides detailed transaction-level information of new issuances of publicly and privately placed bonds. Because the analysis focuses on corporate financing, we exclude all public sector issuances, comprising issuances by national, local, and regional governments, government agencies, regional agencies, and multilateral organizations. We also exclude mortgage-backed securities and other asset-backed securities. The final data set covers 112,125 bonds issued by 15,815 firms (13,670 firms from East Asia and 2,145 firms from Latin America) over 2000-2019 (Table 1). All values in the paper are reported in constant 2011 U.S. dollars.

Summary Statistics

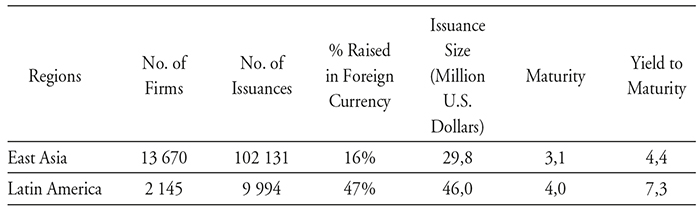

This table shows summary statistics of bond issuances by firms in East Asia and Latin America during 2000-2019. Issuance size, maturiy, and yield to maturity show values for the median issuance in the median economy.

Source: SCD Platinum, Refinitiv.

We distinguish between bond issuances denominated in domestic and foreign currency.1 Domestic currency bonds are those issued by firms in their local currency, based on their country of residence. Foreign currency bonds are those issued by firms in a currency different from the that of their country of residence. To link capital raising issuances with firms’ balance sheet and income statement data, we merge the transaction–level data from SDC with financial statement information for publicly listed firms from Worldscope. These data cover the period 2000-2016.

The Rise of Corporate Bonds in East Asia and Latin America

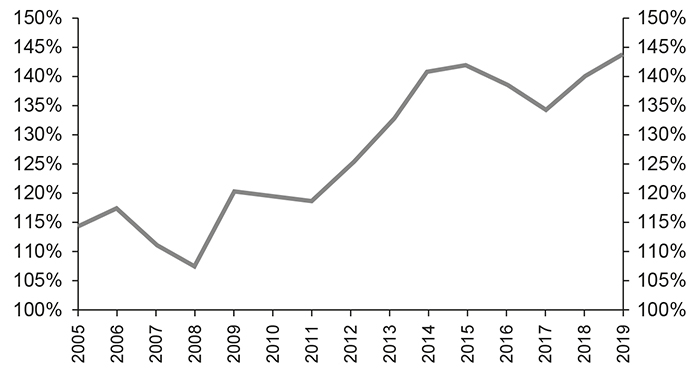

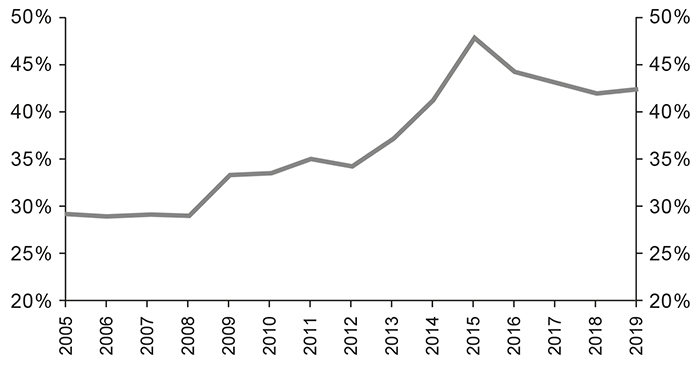

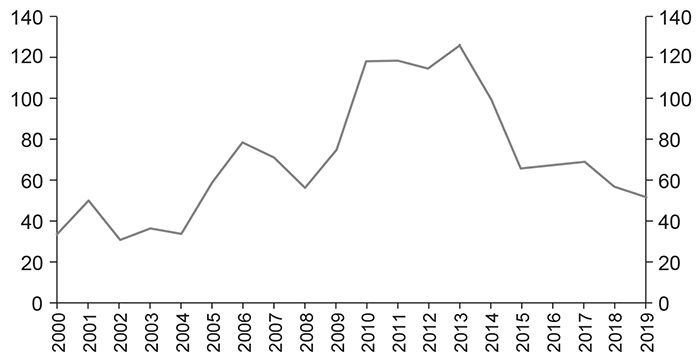

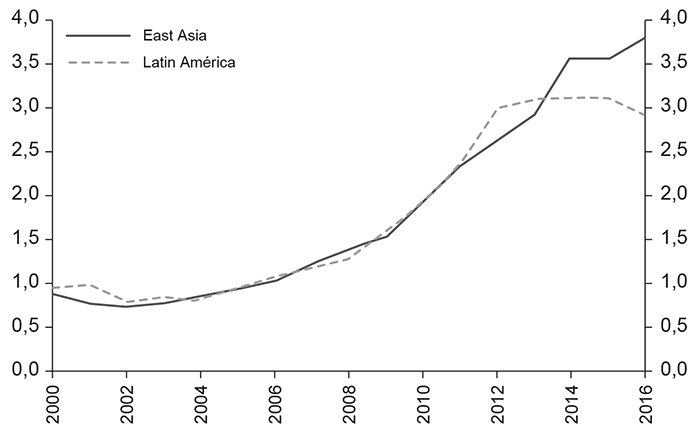

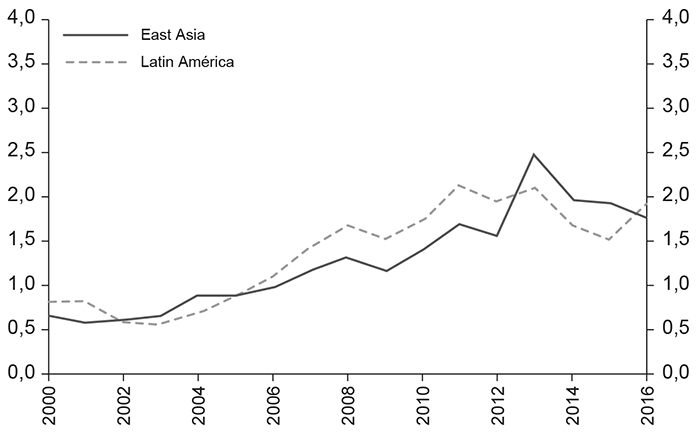

Following the GFC, corporate debt steadily increased among East Asian and Latin American economies. Between 2010 and 2019, the ratio of corporate debt to GDP in the median economy increased from 119 to 144% in East Asia and from 34% to 42% in Latin America (Figure 1, Panel A). An increase in bond issuances by firms accompanied this growth in corporate debt. In the median East Asian and Latin American economy, the annual amount raised in corporate bonds during 2010-2019 was about twice the amount raised during 2000-2007 (Figure 1, Panel B). However, bond financing followed different patterns in each region. In Latin America, the annual amount of bond financing followed an inverted U-shape, peaking in 2013 but then declining in the subsequent years. Although lower than in 2013, the annual amount of bond financing during 2014-2019 was typically larger than during 2000-2007. In contrast, in East Asia the annual amount of bond financing consistently increased throughout 2010-2019.

Growth in Debt

A. Outstanding Debt Over GDP

(% of GDP)

East Asia

Latin America

B. Bond Issuances

(Billion USD)

East Asia

Latin America

These figures show the evolution of corporate debt and bond issuances in East Asia and Latin America. Panel A shows, for each region, the amount of corporate debt outstanding as a share of GDP for the median economy per year. Panel B shows, for each region, the aggregate amount of corporate bonds issued per year. East Asia is split into China and the rest of East Asian economies. Values are in billions of constant 2011 U.S. dollars (USD).

Sources: IIF and Refinitiv's SDC.

The rise of corporate bond financing in East Asia and Latin America is consistent with the so-called “second phase of global liquidity” that started after the GFC (Shin, 2014; Turner, 2014). Prior to the crisis, the banking sector (mainly international banking) was at the center of firm financing in emerging economies. This pattern changed after the GFC, when institutional investors through purchases of corporate bonds replaced banks as key liquidity providers of financing to emerging market firms. In fact, the growth of corporate debt over GDP in emerging economies turns flat when excluding the issuance of bond securities (Abraham et al., 2020). This development resulted in global financing conditions becoming more sensitive to changes in bond markets.

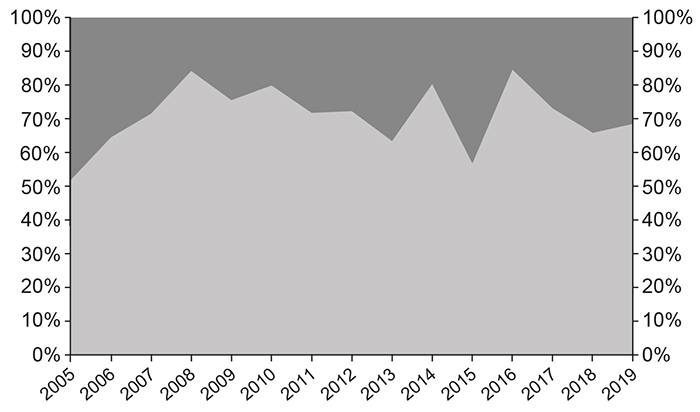

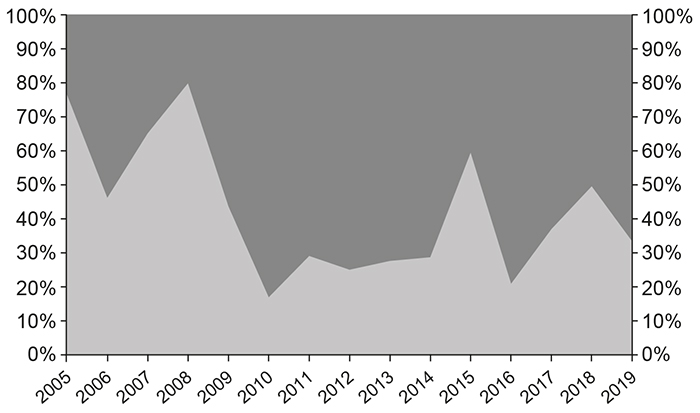

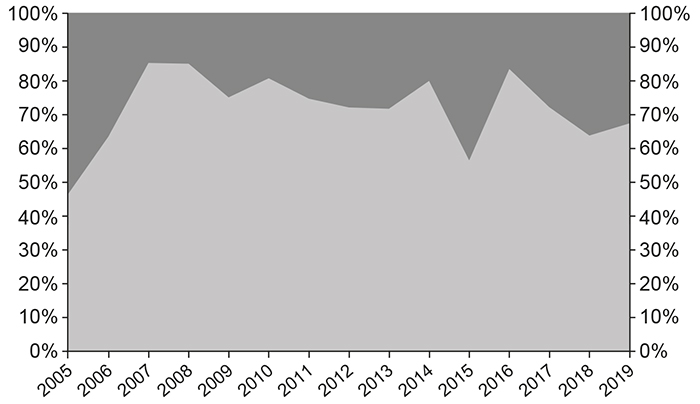

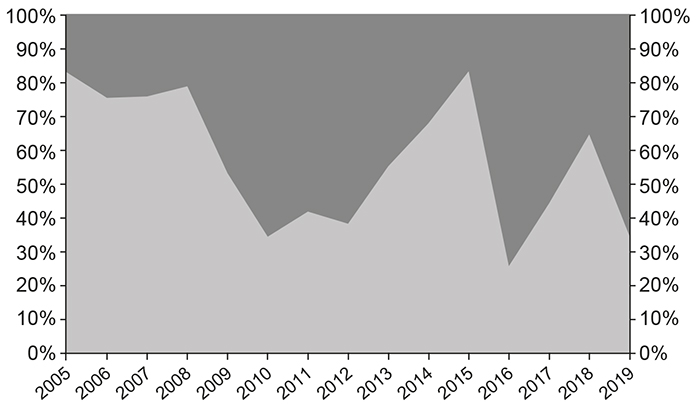

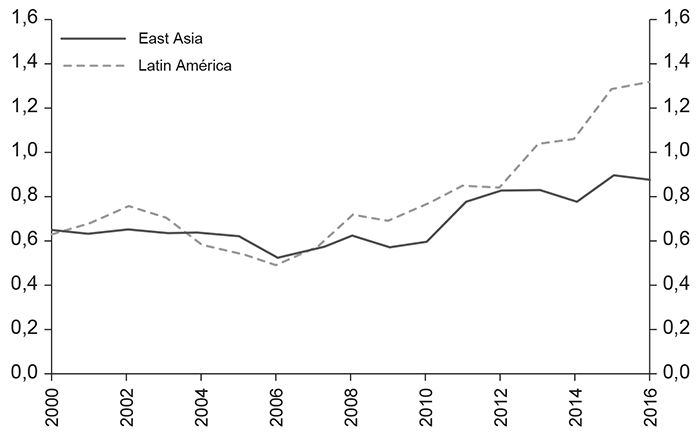

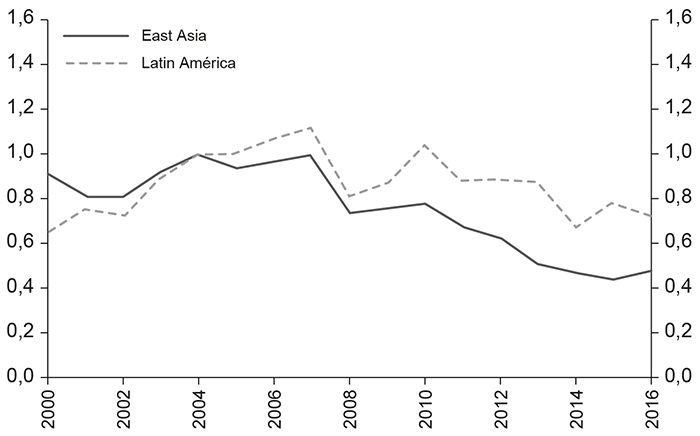

Although firms in both East Asia and Latin America increased their bond issuances during 2010-2019, there is an important difference between the two regions. Whereas in East Asia most of the growth in bond issuances occurred through domestic currency denominated bonds, most of the bonds issued by firms in Latin America were denominated in foreign currency. For example, in the median East Asian economy, 72% of the total amount of bonds raised per year (which includes domestic and foreign currency issuances) was issued in domestic currency during 2010-2019. This represented an increase of 7 p.p. relative to the annual share of domestic currency bond issuances in 2000-2007. This pattern still holds when China is excluded from the sample. In contrast, the share of domestic currency bonds over the total bonds raised per year in the median Latin American economy was 33% in 2010-2019. Importantly, this share indicates a decrease in the proportion of domestic currency bonds raised in Latin America with respect to the pre-GFC period. In 2000-2007, domestic currency bond issuances captured about 57% of the total capital raised in bond markets per year (Figure 2, Panel A). The trends for Latin America hold when splitting the sample between tradable and non-tradable industries (Figure 2, Panel B).

Domestic and Foreign Currency Corporate Bond Issuances

(Share of Bonds Raised)

A. All Sectors

East Asia

Latin America

B. Non-tradable Sector

East Asia

Latin America

This figure shows, for each region, the share of corporate bond financing raised in domestic and foreign currency for the median economy each year. The non-tradable sector includes the following industries: consumer cyclicals, consumer goods conglomerates, consumer non-cyclicals, financials, healthcare, industrial and commercial services, real estate, technology, transportation, and utilities.

Source: Refinitiv's SDC.

There is a close relation between the primary market and currency denomination of the issuances, especially among emerging economies (Gruić; and Wooldrige, 2012; Cortina et al., 2020; Abraham et al., 2021). That is firms in emerging economies typically use domestic markets to issue debt in domestic currency and international markets to issue debt in foreign currency.2 Because of the high correlation between currency denomination and issuance market, the reported trends imply that Latin American firms greatly increased their use of international markets during 2010-2019. In turn, in East Asia most of the new corporate debt was issued in domestic bond markets. Given the home bias in investors’ decisions, these trends also imply that foreign (domestic) investors purchased most of the bonds issued by Latin America (East Asian) firms (Burger et al., 2018; Maggiori et al., 2020). More direct evidence on the portfolio holdings of domestic institutional investors (pension, insurance, and mutual funds) and foreign institutional investors (mutual funds) support the home bias hypothesis (Abraham et al., 2021).

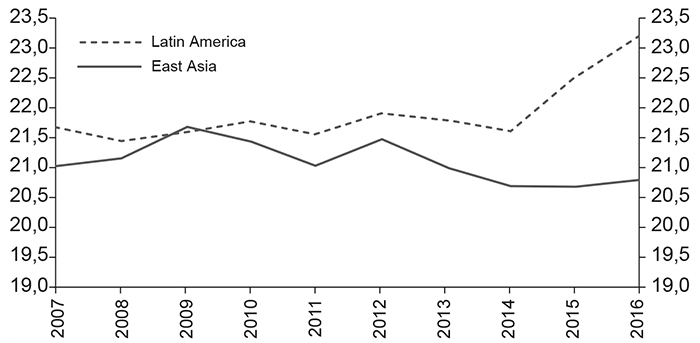

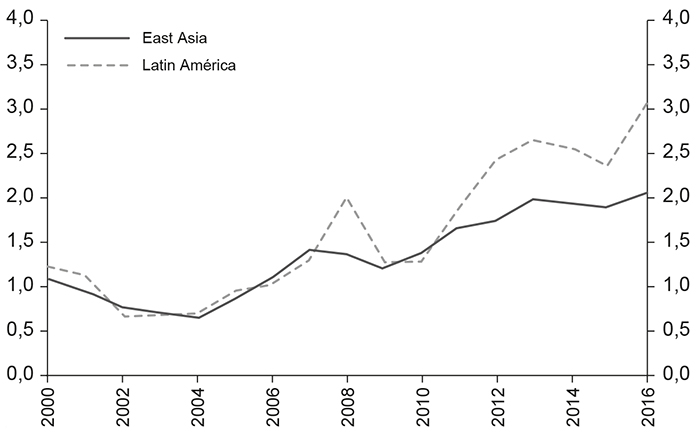

Firms borrowing in international markets are typically larger than those borrowing in domestic markets. In both regions, the size of the median international issuer during 2008-2016 was more than three times the size of the median domestic issuer.3 Therefore, the observed trends also imply that the growth in bond market activity in East Asia comprised the participation of smaller issuing firms than in Latin America. In fact, the size of the median firm issuing bonds declined (increased) in East Asia (Latin America) as the use of domestic (international) markets expanded after the GFC (Figure 3). In 2016, the median asset size of publicly listed issuing firms in Latin America was $10 billion U.S. dollars, more than ten times higher than that in East Asia ($1 billion U.S. dollars). The differences are also substantial when comparing all firms (listed and unlisted) using the size of bond issuances.4 The median issuance size in Latin America was $118 million U.S. dollars in 2016, more than four times higher than that in East Asia ($28 million U.S. dollars).

Size of Bond Issuers

(Log of Issuer Size)

This figure shows, for each region, the size of the median firm in the median economy issuing bonds each year. Firm size is measured as the end-of-year value of total assets.

Sources: Refinitiv's SDC; Worldscope.

Drivers and Consequences for Firms

What was the main cause behind the acceleration in bond issuances in East Asia and Latin America after 2008? There are two main possibilities. One is that new growth opportunities for firms that required financing explain the increasing levels of debt (demand-side driven). The other possibility is that easier financing conditions (cheaper financing) generated by the behavior of investors prompted firms to issue more debt than needed to finance operations (supply-side driven).

A large literature argues that supply-side factors were key to the rise in foreign bond issuances in emerging economies (McCauley et al., 2015; Caballero et al., 2016; Burger et al., 2018). The expansion in the supply side of foreign currency bond financing was a result of international investors “searching for yield” in emerging markets, as expansionary monetary policies in developed economies following the GFC lowered bond yields to historically low levels. In the context of low interest rates, international investors turned away from safe assets in developed economies in favor of high-yield corporate and sovereign bonds issued by emerging economies (Calomiris et al., 2019). In particular, the median spread between the yields of U.S. dollar denominated bonds issued by firms in East Asia and the yields of U.S. dollar bonds issued by firms in developed economies was 100 basis points during 2009-2011. In Latin America, the spread was even larger, standing at 175 basis points. In addition, there is evidence that an increase in the supply of financing was central to the growth of domestic bond issuances in East Asia (Abraham et al., 2021). In this case, domestic investors, with substantial and growing funds, were the main buyers of domestic securities, contributing to the decline in the cost of capital in domestic markets.

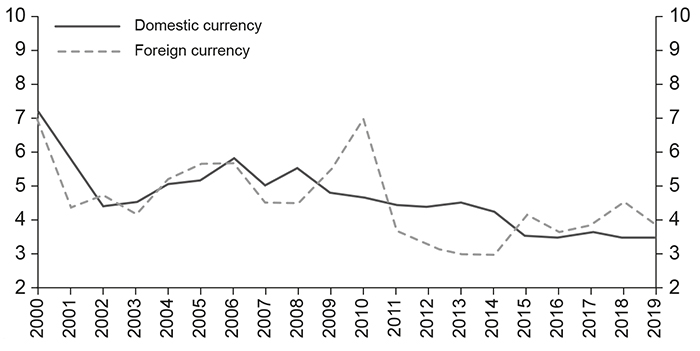

The cost of issuing bonds declined after the GFC in Latin America and East Asia, which is consistent with the notion that an expansion in the supply of bond financing by investors drove the rise in bond issuances by firms.5 In particular, the yields to maturity (at issuance) declined in East Asia and Latin America as the amount of bond financing increased after the GFC. In 2010-2019, East Asian and Latin American firms issued bonds at yields that were about 25% lower than in 2000-2007. In East Asia, yields of domestic currency bonds declined more than yields of foreign currency bonds (26 vs. 22 percent, respectively). In contrast, in Latin America yields of foreign currency bonds fell more than those of domestic currency bonds (30% vs. 23%, respectively) (Figure 4). These patterns are consistent with the differences observed in the issuance of domestic and international bonds by firms in the two regions.

Cost of Issuing Corporate Bonds

(Percentage Points)

East Asia

Latin America

This figure shows the median yield to maturity of domestic and foreign currency corporate bonds issued by firms in East Asia and Latin America each year.

Source: Refinitiv's SDC.

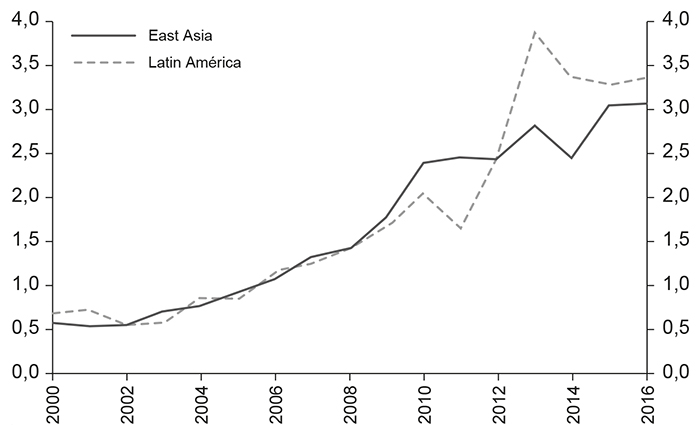

As the supply of financing increased, firms that issued bonds in East Asia and Latin America from 2010 onwards substantially increased the amount of debt outstanding in their balance sheets (Figure 5). Total debt for the median bond issuer in East Asia (Latin America) in 2016 was 3.8 (2.9) times the average value in 2000-2007. Moreover, bond issuers accumulated assets at a slower rate than debt, increasing their leverage (debt over assets) positions. In 2016, the median bond issuer in East Asia and Latin America had, on average, a leverage ratio that was 40% and 20% higher than that in 2000-2007, respectively. Other measures of corporate leverage, such as the ratio of debt to equity, also increased among emerging market issuers.

Trends in Balance Sheet and Income Statement Variables

Debt

Leverage (Debt/Assets)

Interest Expenses

Cash

Capital Expenditures (CAPEX)

Return on Equity (ROE)

This figure shows the trends in financial statement variables for firms in East Asia and Latin America that issued bonds during 2010-2016. All variables are normalized by their average value during 2000-2007. For each variable and region, the figure shows the results for the median firm in the median economy per year.

Sources: Refinitiv's SDC; Worldscope.

Although bond issuers used part of the new debt to conduct some investments, they also accumulated a substantial amount of cash. In 2016, the median bond issuer in East Asia and Latin America had cash holdings that were about three times the average holdings in 2000-07. In comparison, capital expenditures (CAPEX) of the median bond issuer were about 1.8 times the average value in 2000-07 in both East Asia and Latin America (Figure 5). Evidence of large cash accumulation also supports the argument that the supply of financing accelerated faster than the demand, as it suggests that firms took advantage of favorable liquidity conditions to raise more debt than the amount needed to finance existing operations (Erel et al., 2012; Acharya et al., 2020).

Declining financial performance was characteristic of firms issuing bonds from 2010 onwards. The return on equity (ROE) declined for bond issuers in East Asia and Latin America after 2008. Although firms faced cheaper financing in bond markets, weak performance could imply that the large cash holdings yielded even lower returns than the financing cost. It might also be the case that the financing directed to new investments was geared toward projects with low rates of return.

Risks Associated with the COVID-19 Shock

East Asian and Latin American firms increased their bond issuance activity and overall indebtedness during a long period of easy financing conditions in bond markets (2010-2019), which was also characterized by low economic growth and declining corporate earnings, exposing firms to negative shocks. Analysts raised concerns that high debt accumulation increased solvency risks across emerging economies and could trigger a new financial crisis, even before the COVID-19 outbreak in the first quarter of 2020 (Beltrán et al., 2017; Financial Times, 2017).6

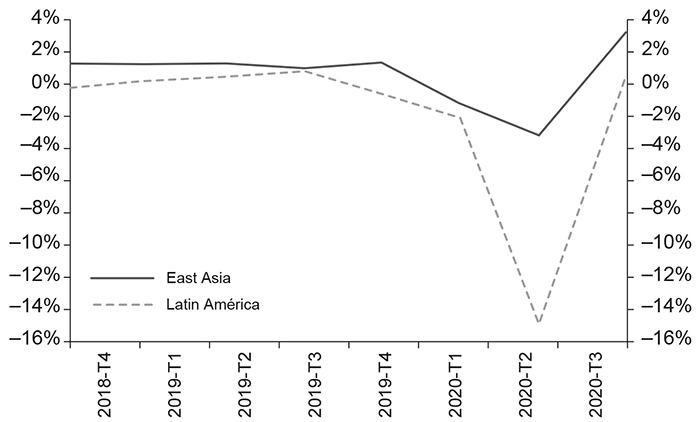

The sharp economic decline resulting from the COVID-19 pandemic only accentuated those concerns about solvency risks for firms in East Asia and Latin America. Lockdowns and border closures to contain the pandemic likely exacerbated the short-term decline in global economic activity, which is expected to contract by 4.4% by the end of 2020 (IMF, 2020a). The fall in output was particularly large among Latin American economies. In the second quarter of 2020, GDP fell by 3.15% and 14.9% for the median economy in East Asia and Latin America, respectively (Figure 6). For firms in both regions, less economic activity resulted in lower earnings, reducing the funds available to repay their debts. In Latin America, profitability of the median firm (measured as return on assets) fell from an average of 3% during 2013-2019 to 2% in the second quarter of 2020. In this scenario, the share of debt held by financially weak firms (“debt-at-risk”) increased since early 2020.7 In Latin America, the share of debt-at-risk jumped to 29% in the second quarter of 2020 from an average value of 4% during 2016-2019 (IMF, 2020b). A similar pattern can be observed in East Asia, where an increase in firm leverage since the pandemic coupled with weak revenues increased the risk of bankruptcies (S&P Global, 2020).

GDP Growth, Quarterly

This figure shows the quarterly growth in Gross Domestic Product (GDP) for the median economy in East Asia and Latin America. East Asia includes China, Indonesia, and the Republic of Korea. Latin America includes Argentina, Brazil, Chile, Colombia, and Mexico.

Source: OECD.

The COVID-19 pandemic also heightened concerns about rollover risks.8 Prior to the pandemic, emerging market firms could have increased their rollover risks if the new bonds were issued at shorter maturities than in the past. In fact, throughout 2008-2018 the average maturity of corporate bonds in emerging economies consistently declined (Çelik et al., 2019). The shorter maturities mean that, of the total outstanding amount of corporate bonds in emerging economies at the end of 2019, almost 50% was set to mature during 2020-2023 (Çelik et al., 2020). Our data show that the decline in bond maturities was higher in East Asia than in Latin America. The maturity of bond issuances by East Asian (Latin American) firms declined from 4.3 (7.1) years in 2004-2007 to 3.7 (6.7) years in 2010-2019.9 A total value of $3,327 billion U.S. dollars (17 percent of GDP in 2019) and $263 billion U.S. dollars (6% of GDP in 2019) in corporate bonds was set to mature during 2020-2023 in East Asia and Latin America, respectively.

Several East Asian and Latin American firms will probably need to eventually issue new debt to rollover their existing debt obligations and/or to cover their operational expenses. Throughout 2020, government support (which in some cases included direct intervention in bond markets) allowed firms to conduct new issuances and refinance existing debt (Darmouni and Siani, 2020). In addition, after markets experienced a sharp decline at the start of the pandemic, investors resumed financing and many firms raised records amounts of financing in 2020 that helped them accumulate more cash savings and cope with their financing risks (Economist, 2020a). Whereas these developments might have kept rollover risks in check during 2020, there are concerns that many firms could be left with a significant amount of debt that investors might not be willing to refinance. This issue could be particularly relevant because firms in East Asia and Latin America have become more vulnerable to changes in market conditions, as favorable liquidity conditions (rather than new investment opportunities) drove the increasing borrowing before the COVID-19 shock. The so-called “zombie firms” that the pandemic has produced might exacerbate this problem (Economist, 2020b; Financial Times, 2020).10

In addition, the shift from bank to bond financing could make refinancing harder than before the GFC. Bond debt is more difficult to restructure than bank debt and the investor sentiment in bond markets is especially sensitive to negative shocks to the macroeconomic, sectoral, and firm-level projections for the issuers (Hackbarth et al., 2007; Acharya et al., 2015; Crouzet, 2018). Therefore, it is unclear whether investors would still be interested in buying emerging market corporate bonds when the time to refinance comes.

Despite the significant risks for firms in East Asia and Latin America, the two regions seem to be in a different position to deal with the debt-related risks posed by the COVID-19. One major difference between East Asia and Latin America has been that external factors can affect more the latter than the former. Because domestic investors in domestic currency were behind the rise in bond issuances in East Asia whereas foreign investors drove a large fraction of the foreign currency issuance activity in Latin America, firms in Latin America became more vulnerable to exchange rate depreciations and deteriorations in global market sentiment.

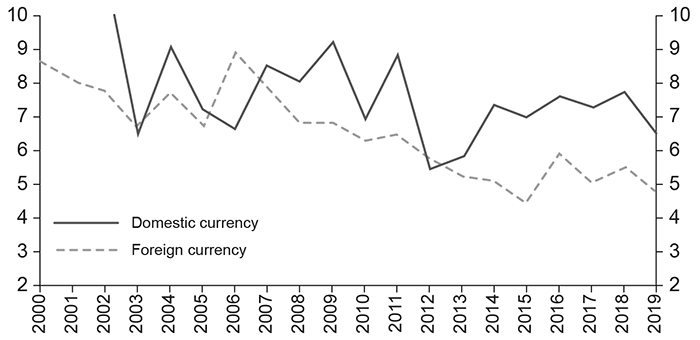

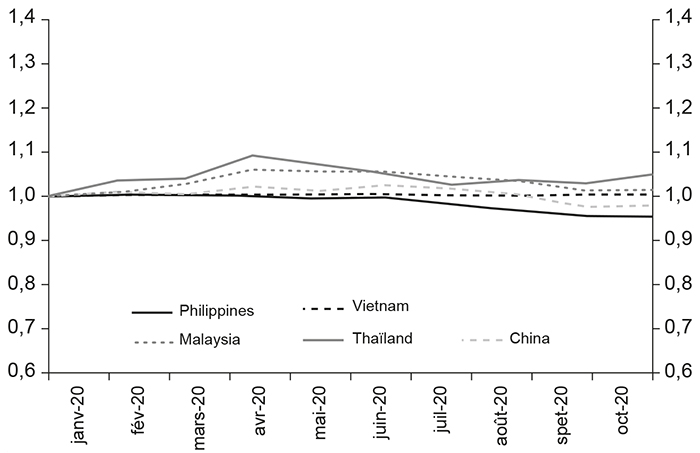

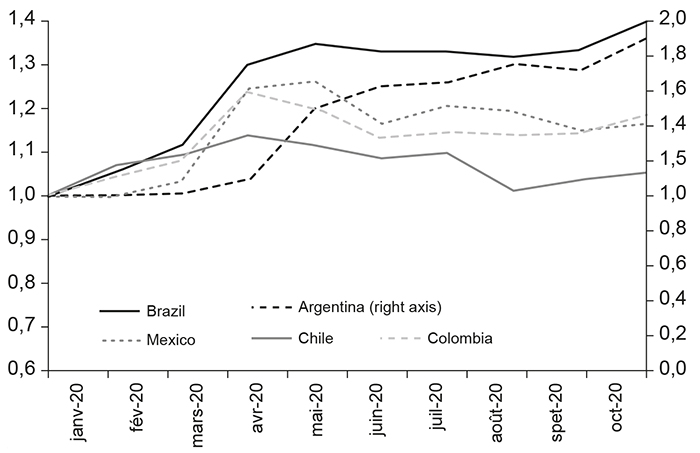

This difference is not trivial as the COVID-19 shock was associated with record capital short-term outflows from emerging economies. Outflows from emerging economies could affect disproportionally more the rollover risks of Latin American firms than those of East Asian firms because the former relied more on foreign currency financing before the pandemic. Moreover, these capital outflows were often accompanied by exchange rate depreciations, increasing currency risks (BIS, 2020; Hördahl and Shim, 2020). Currency risks are present when firms issue debt in foreign currency, but then use the proceeds to invest and generate earnings in domestic currency. In fact, Latin American economies experienced substantially higher depreciations in their local currencies than East Asian economies (Figure 7).

Exchange Rates: Domestic Currency to U.S. Dollar

East Asia

Latin A

This figure shows, for selected economies in East Asia and Latin America, the value of one U.S. dollar in domestic currencies. Values are indexed by the value in January 2020. Due to differences in magnitudes, the values for Argentina are plotted in the right axis of panel B.

Source: Refinitiv's Datastream.

Currency depreciations can have a significant negative effect on corporate balance sheets of firms that borrowed in foreign currency if their currency exposures are not fully hedged operationally (e.g., with firm exports) or financially (e.g., with financial derivatives) (Caballero, 2020). Firms in the tradable sector, which are expected to receive income in foreign currency, have a natural hedge against currency shocks. But those firms were not the only ones that increased their reliance on international issuances in Latin America. Firms in the non-tradable sector did not issue less in foreign currency than those in the tradable sector (Figure 2). Currency risks augmented for non-tradable firms because they increased their debt issuances in foreign currency after the GFC, whereas their revenues are typically denominated in domestic currency.

Another important difference between the two regions is the type of firm behind the reported expansion in bond issuances, which could result in a different exposure to rollover risks. As shown in Section 3, smaller firms were part of the expansion in bond issuances in East Asia during 2010-2019 relative to Latin America. Due to higher information asymmetries, agency problems, and other frictions, smaller firms are more likely to issue short term than larger firms (Gregory et al., 2005; García-Teruel and Martínez-Solano, 2007). Indeed, as mentioned above, the average maturity of corporate bond issuances during 2010-2019 was 3.7 years in East Asia and 6.7 years in Latin America. Furthermore, these frictions could result in smaller firms having less access to financial markets during economic downturns, when investors become more risk averse. In fact, similar to what had already occurred during the GFC, larger firms had better access to bond markets than smaller firms during the first quarters of the pandemic (Cortina et al., 2020; Goel and Serena, 2020).

Conclusion

The evidence in the paper shows an expansion in corporate bond issuances in East Asia and Latin America during 2010-2019. The rise in East Asian bond issuances was mostly conducted through domestic markets, denominated in domestic currencies, and driven by domestic investors. The rise in Latin American bond issuances was mostly conducted through international markets, denominated in foreign currency, and driven by foreign investors. Borrowing firms in both regions increased their leverage and worsened their financial performance. Whereas the COVID-19 shock heightened debt related risks for firms in East Asia and Latin America, the two regions seem to have different exposures to the shock. Risks in East Asia have been more related to higher overall indebtedness and the participation of smaller firms issuing bonds at shorter maturities. Latin America has been more exposed to foreign market conditions and exchange rate risks than East Asia.

Overall, a key difference between the two regions in terms of bond borrowing during 2010-2019 was the different use of domestic and international markets. The much higher use of domestic bond markets by firms in East Asia could have been related to different factors. In part, domestic bond market growth in East Asia could have come as a result of the 1997-1998 Asian Financial Crisis, after which policy makers implemented reforms to reduce reliance on foreign financing (Mizen and Tsoukas, 2014; Bose et al., 2019). Another reason could be stronger fiscal discipline by East Asian governments, relative to their Latin American counterparts. Stronger fiscal positions could have reduced crowding out and, as a result, increased financing toward the corporate sector. Rapid economic growth since the early 2000s, which substantially increased savings in East Asian economies could have also played a role. Richer households with more savings might have increased investments in financial products. Higher demand for investment products, coupled with a home bias, could have increased the flow of funds toward domestic bond markets through domestic institutional investors.